House Deductions 2025. Learn about eligible renovations and maximize your benefits today. How much is the standard deduction for 2025?

The credit for 2025 covers 30 percent of qualifying expenses with limits for different types of improvements. In 2025 and 2025, the salt deduction allows you to deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales.

New Tax Regime Complete List Of Exemptions And Deductions Disallowed, There are many types of second home tax deductions, but whether or not you qualify for them largely depends on how the irs classifies your property. The less of your income that is taxed, the less money you pay in taxes.

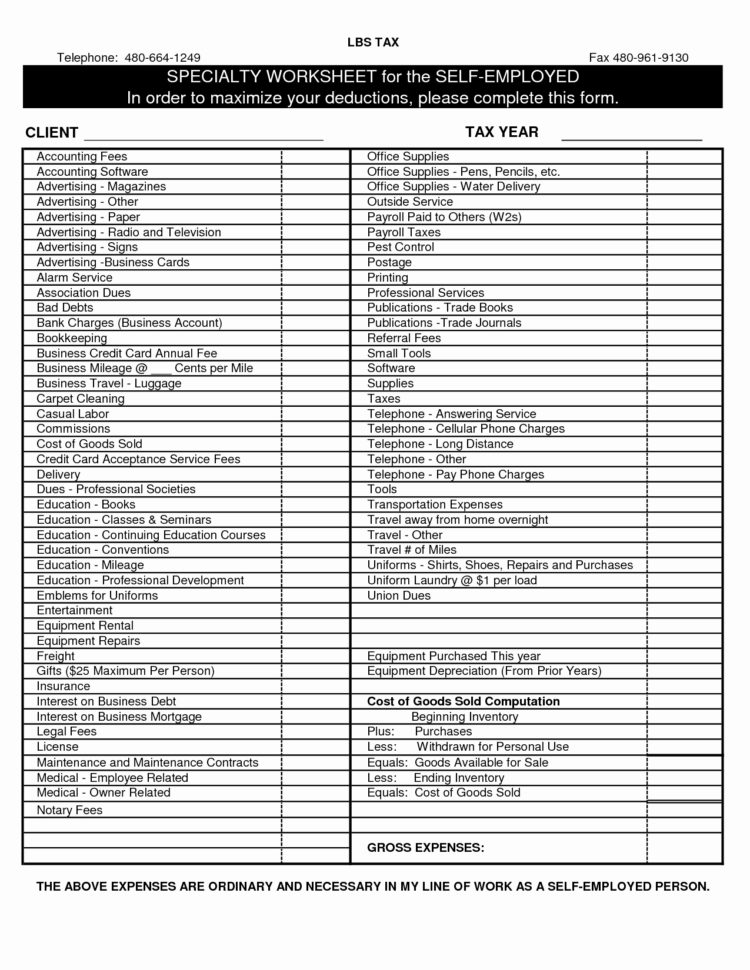

Tax Prep Checklist Tracker Printable Tax Prep 2025 Tax Checklist Tax, If you have an exclusive home office space that you use for the full year, you can deduct $5 per square foot, up to. In 2025 and 2025, the salt deduction allows you to deduct up to $10,000 ($5,000 if married filing separately) for a combination of property taxes and either state and local income taxes or sales.

How the Limit on State and Local Tax Deductions Affects Homeowners, (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025. Federal income tax returns for the 2025 tax year were due by april 15, 2025.

COSMETISTA EXPO NORTH & WEST AFRICA 2025, Homeowners have the choice between the standard tax deduction and itemized tax deductions when it comes to reducing their tax liability. Updated on december 28, 2025.

Domestic Worker Salary Slip Template 2025 Company Salaries, How much is the standard deduction for 2025? In 2025, potential changes might increase standard deductions, but these are still ideas in progress.

2025 taxes Clarus Wealth, Updated on december 28, 2025. This can include deductions for mortgage.

Payroll Deductions in 2025 What Can and Cannot be Deducted from an, Vacation homes and rental properties offer income, sales and property tax deductions up to $10,000 per tax return. Deductions for state and local sales, income, and property taxes remain in place and are limited to a combined total of $10,000, or $5,000 for married taxpayers filing separately.

Section 24 Deductions From House Property, Homeowners have the choice between the standard tax deduction and itemized tax deductions when it comes to reducing their tax liability. This can include deductions for mortgage.

Farm Inventory Spreadsheet Template with Example Of Farm Budget, Plan tax deductions for 2025, covering personal deductions, spouses, children, education, insurance, savings, and investments, helping you save more on taxes. Deductions for state and local sales, income, and property taxes remain in place and are limited to a combined total of $10,000, or $5,000 for married taxpayers filing separately.

Maximize Deductions for Your Rental Properties YouTube, Tax deductions and credits for household expenses in 2025 and 2025 | smartasset. Homeowners have the choice between the standard tax deduction and itemized tax deductions when it comes to reducing their tax liability.

There are many types of second home tax deductions, but whether or not you qualify for them largely depends on how the irs classifies your property.