2025 Home Energy Tax Credits. Our tracker shows which states and territories have applied for. Business category citi says 42% of energy clients lack climate transition plans march 28, 2025 climate change category dutch government offers tata steel subsidies to.

China has requested wto dispute consultations with the united states regarding certain tax credits under the us inflation reduction act to promote the production of electric vehicles and. The energy efficient home improvement credit lets homeowners claim up to $3,200 per year for eligible upgrades, such as energy efficient windows, ac units, and water.

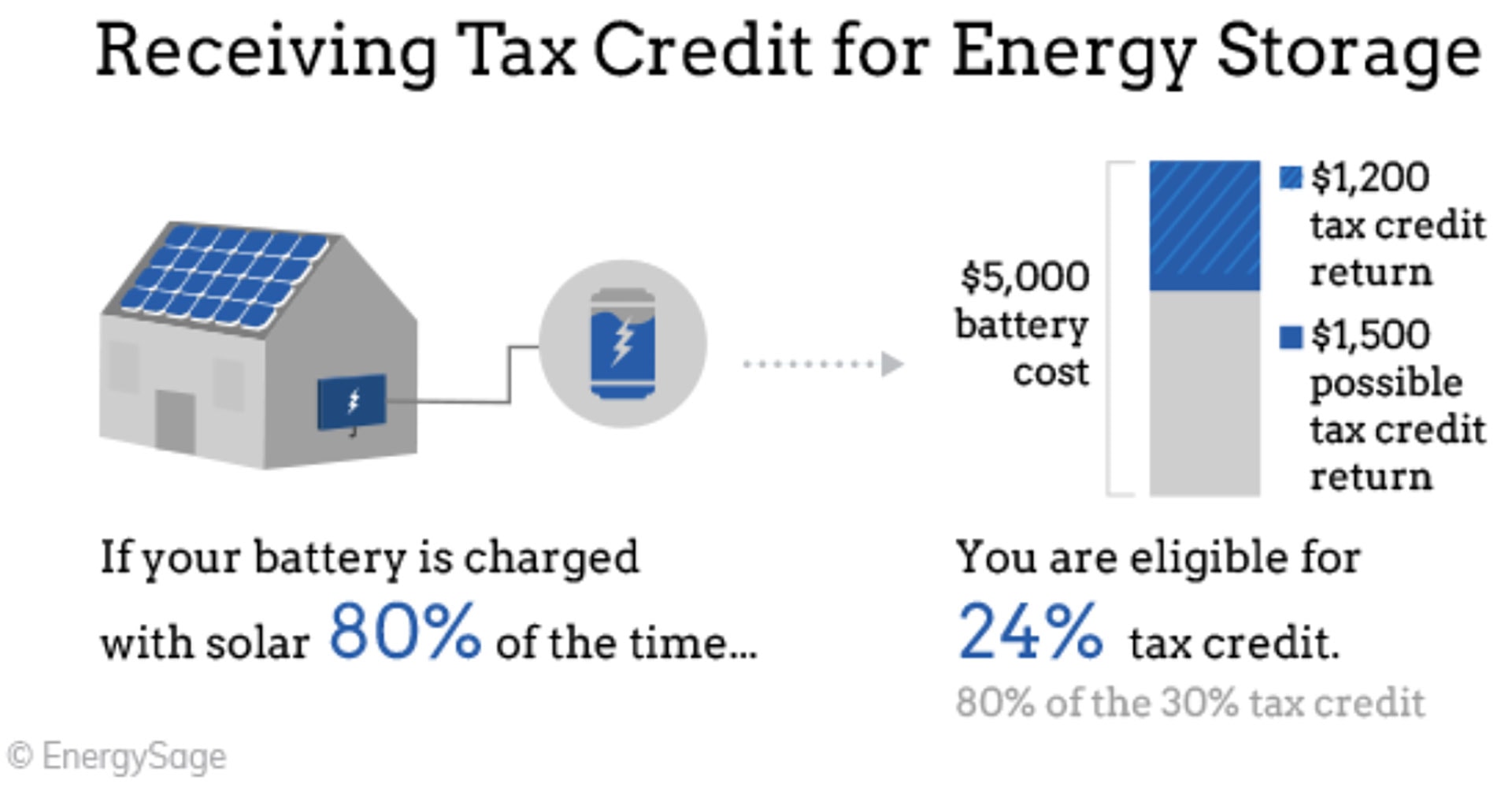

Beginning with the 2025 tax year (tax returns filed now, in early 2025), the credit is equal to 30% of the costs for all eligible home improvements made during the year.

Solar Tax Credit What You Need To Know NRG Clean Power, Beginning with the 2025 tax year (tax returns filed now, in early 2025), the credit is equal to 30% of the costs for all eligible home improvements made during the year. The inflation reduction act of 2025 created two programs to encourage home energy retrofits:

Federal Tax Credit for Saving Money on Solar Panels KC Green Energy, With the average coming in at around , making the switch to solar is a substantial investment. State heat pump installation incentives.

Federal Solar Tax Credits for Businesses Department of Energy, A home energy audit is just one of the many efficiency or home energy. According to the irs website, through dec.

Use of Residential Energy Tax Credits Increases Eye On Housing, Home efficiency rebates (homes) to fund whole house energy efficiency. Our tracker shows which states and territories have applied for.

The New Federal Tax Credits and Rebates for Home Energy Efficiency, By sam wigness | dec 22, 2025. The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements.

Residential Energy Tax Credit Use Eye On Housing, How to make the most of energy efficiency tax credits in 2025. Making our homes more efficient:

Residential Energy Tax Credits Overview and Analysis UNT Digital Library, Beginning with the 2025 tax year (tax returns filed now, in early 2025), the credit is equal to 30% of the costs for all eligible home improvements made during the year. How do you claim the solar tax credit?

Determining Eligibility for the Solar Investment Tax Credit Geoscape, Business category citi says 42% of energy clients lack climate transition plans march 28, 2025 climate change category dutch government offers tata steel subsidies to. The questions and answers below refer to claims for the 2025 oeptc, which you apply for on your 2025 income tax and benefit return.

Form 5695 Fill out & sign online DocHub, Our tracker shows which states and territories have applied for. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025.

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, Our tracker shows which states and territories have applied for. Clean energy tax credits for consumers.

The questions and answers below refer to claims for the 2025 oeptc, which you apply for on your 2025 income tax and benefit return.

2025 Home Energy Tax Credits. Our tracker shows which states and territories have applied for. Business category citi says 42% of energy clients lack climate transition plans march 28, 2025 climate change category dutch government offers tata steel subsidies to. China has requested wto dispute consultations with the united states regarding certain tax credits under…